Did you know today is Gift Aid Awareness Day?

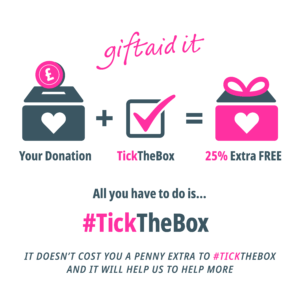

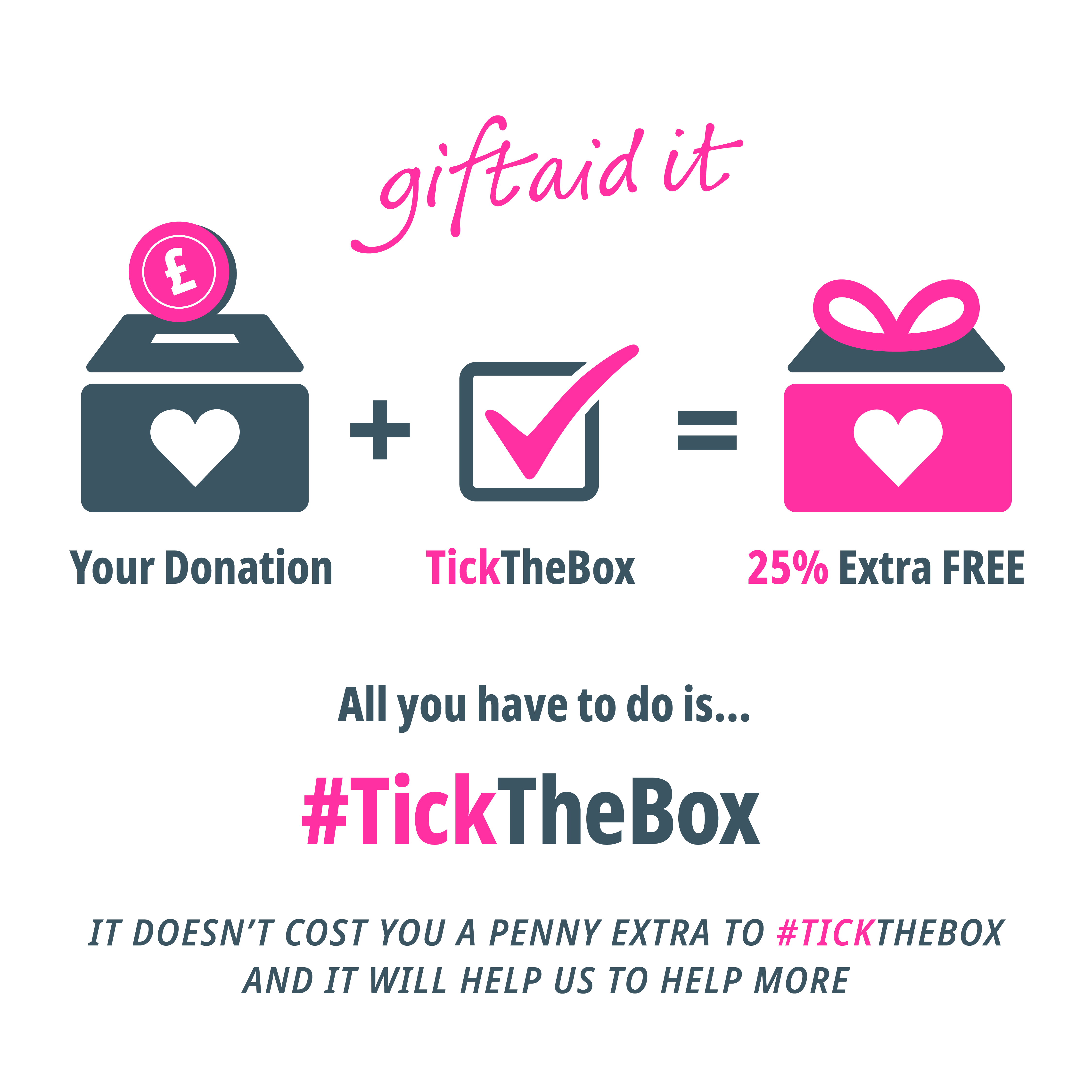

Donating through Gift Aid means charities such as ourselves can claim an extra 25p for every £1 you give.

And that makes such a difference; particularly to non-profit charities such as ourselves.

What is Gift Aid?

To qualify for Gift Aid, you must:

- Be a UK taxpayer

- Have paid or expect to pay enough income or capital gains tax in the tax year your gift was received

- Make a Gift Aid declaration

You can make a Gift Aid declaration by either ticking the Gift Aid box when you donate or filling in the online Gift Aid form (for many, the former is easier and quicker than the latter!)

And here’s the best bit. Gift Aid doesn’t cost you anything extra. This is because you’ve already paid tax on the money you’re donating. Once the charity receives your donation, HMRC returns the tax you originally paid to top up the donation.

If you pay tax at a higher rate than the basic rate, you can claim back extra tax from HMRC. You can do this by completing the appropriate section on your tax return or by contacting HMRC.

Donating to LNBP…with Gift Aid

All donations we receive enable us to not only continue our work but also provide assistance to groups or individuals so that they can enjoy a short break or holiday with us that they may not be in a position to otherwise afford.

All donations we receive enable us to not only continue our work but also provide assistance to groups or individuals so that they can enjoy a short break or holiday with us that they may not be in a position to otherwise afford.

You can donate to LNBP online with links to our TotalGiving page on our website HERE

You can donate to LNBP online with links to our TotalGiving page on our website HERE

Just don’t forget to tick the Gift Aid box too!

Thank you for your support and generosity.